The smart Trick of Matthew J. Previte Cpa Pc That Nobody is Talking About

Remarkable conditions show repayment in complete would trigger extreme monetary hardship, would certainly be unreasonable or would be inequitable. The internal revenue service can use up to two years to approve or deny your Deal in Compromise. You desire it to be as convincing as feasible. Currently we relocate into criminal region. A lawyer is essential in these circumstances.

Tax obligation laws and codes, whether at the state or government degree, are as well made complex for a lot of laypeople and they change frequently for several tax obligation specialists to stay up to date with. Whether you simply require a person to help you with your organization revenue tax obligations or you have actually been billed with tax scams, employ a tax attorney to help you out.

8 Easy Facts About Matthew J. Previte Cpa Pc Shown

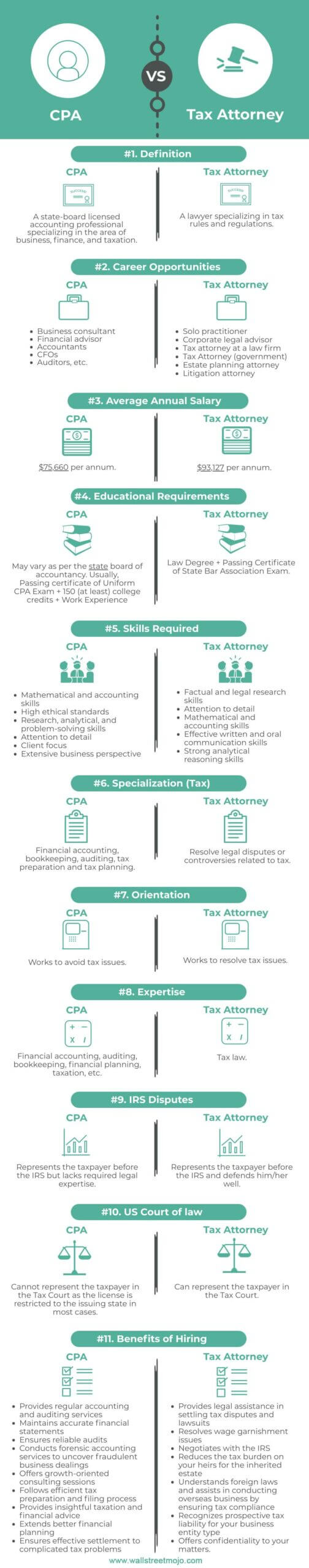

Every person else not only dislikes dealing with tax obligations, however they can be outright worried of the tax obligation companies, not without factor. There are a couple of inquiries that are always on the minds of those that are taking care of tax obligation problems, consisting of whether to hire a tax attorney or a CERTIFIED PUBLIC ACCOUNTANT, when to hire a tax attorney, and We wish to help respond to those inquiries right here, so you know what to do if you locate on your own in a "taxing" situation.

An attorney can represent clients before the internal revenue service for audits, collections and allures but so can a CPA. The huge difference right here and one you require to bear in mind is that a tax obligation lawyer can give attorney-client benefit, suggesting your tax attorney is excluded from being compelled to affirm versus you in a law court.

How Matthew J. Previte Cpa Pc can Save You Time, Stress, and Money.

Otherwise, a CPA can indicate versus you even while working for you. Tax obligation lawyers are a lot more familiar with the various tax settlement programs than many CPAs and understand exactly how to select the very best program for your case and just how to obtain you gotten approved for that program. If you are having a trouble with the internal revenue service or simply questions and concerns, you require to employ a tax lawyer.

Tax obligation Court Are under examination for tax fraud or tax evasion Are under criminal examination by the internal revenue service An additional crucial time to work with a tax obligation lawyer is when you obtain an audit notification from the IRS - tax attorney in Framingham, Massachusetts. https://www.kickstarter.com/profile/taxproblemsrus1/about. A lawyer can connect with the internal revenue service in your place, exist throughout audits, aid work out negotiations, and maintain you from paying too much as an outcome of the audit

Component of a tax obligation attorney's duty is to keep up with it, so you are protected. Ask about for a skilled tax obligation lawyer and inspect the internet for client/customer testimonials.

Getting My Matthew J. Previte Cpa Pc To Work

The tax obligation lawyer you have in mind has all of the ideal qualifications and reviews. Should you employ this tax attorney?

The choice to work have a peek here with an internal revenue service attorney is one that need to not be taken gently. Lawyers can be incredibly cost-prohibitive and make complex issues needlessly when they can be resolved relatively easily. In general, I am a big proponent of self-help legal services, particularly offered the selection of informational material that can be discovered online (consisting of much of what I have published on the subject of tax).

Top Guidelines Of Matthew J. Previte Cpa Pc

Below is a quick checklist of the issues that I think that an IRS lawyer should be worked with for. Let us be entirely honest for a 2nd. Offender fees and criminal investigations can damage lives and bring really significant repercussions. Anybody that has hung around behind bars can fill you know the realities of jail life, yet criminal fees typically have a far more punitive impact that lots of people fall short to consider.

Crook fees can also carry added civil penalties (well beyond what is typical for civil tax issues). These are just some instances of the damage that even simply a criminal cost can bring (whether or not a successful conviction is inevitably gotten). My point is that when anything potentially criminal emerges, even if you are simply a potential witness to the issue, you need an experienced IRS lawyer to represent your rate of interests against the prosecuting firm.

Some might cut short of nothing to acquire a conviction. This is one circumstances where you always require an internal revenue service lawyer viewing your back. There are several parts of an IRS lawyer's job that are seemingly routine. Many collection matters are managed in about the very same means (although each taxpayer's scenarios and objectives are various).

The 8-Minute Rule for Matthew J. Previte Cpa Pc

Where we earn our red stripes though is on technological tax issues, which placed our full skill established to the examination. What is a technical tax issue? That is a difficult inquiry to address, however the best means I would certainly explain it are matters that need the expert judgment of an internal revenue service attorney to resolve effectively.

Anything that possesses this "reality reliance" as I would call it, you are going to intend to bring in a lawyer to seek advice from - Unpaid Taxes in Framingham, Massachusetts. Even if you do not preserve the services of that lawyer, a professional perspective when handling technical tax obligation issues can go a long way toward understanding concerns and solving them in an ideal way

Comments on “The 3-Minute Rule for Matthew J. Previte Cpa Pc”